以下是一个关于加密货币的英语解说稿结构,包

Cryptocurrency refers to a type of digital or virtual currency that uses cryptography for security. Unlike traditional currencies issued by governments (also known as fiat currency), cryptocurrencies are decentralized and typically built on a technology called blockchain. This innovative structure enables cryptocurrencies to operate independently of a central authority, making transactions more secure and transparent.

The concept of cryptocurrency gained traction in 2009 with the launch of Bitcoin, the first ever digital currency created by an anonymous person or group known as Satoshi Nakamoto. Since then, thousands of altcoins have been developed, each offering different functionalities and features.

Understanding cryptocurrency is crucial for investors, technologists, and anyone interested in the future of finance, as it represents a significant shift in how people approach assets and transactions globally.

#### 2. How Cryptocurrency WorksThe core technology behind all cryptocurrencies is the blockchain, a distributed ledger that records all transactions across a network of computers. This technology ensures transparency, as anyone can view the transaction history without altering the data. The decentralization of blockchain means there’s no single point of failure, making it secure from potential fraud or manipulation.

Mining is a vital part of cryptocurrency, where miners use powerful computers to solve complex mathematical problems. This process validates transactions and adds them to the blockchain while also generating new coins. The incentives for miners include transaction fees and newly minted coins, which are key to maintaining the network.

#### 3. Types of CryptocurrenciesBitcoin remains the most well-known cryptocurrency, but it’s just one among thousands. Ethereum introduced smart contracts, which allow developers to create decentralized applications on its blockchain. Furthermore, there are altcoins, which are alternatives to Bitcoin, and tokens that are built on existing blockchains.

Recent trends indicate the emergence of stablecoins like Tether, which aim to reduce volatility by pegging their value to traditional assets. Understanding these various types of cryptocurrencies is essential for investors looking to diversify their portfolios.

#### 4. Investing in CryptocurrencyStarting an investment in cryptocurrency involves several steps, including selecting a reputable exchange to buy coins and setting up a digital wallet to store them. Wallets can be hot (online) or cold (offline) storage, with cold wallets generally considered more secure.

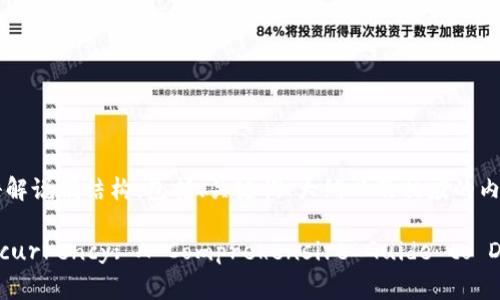

Investment strategies vary widely among investors. Some choose to HODL, or hold their assets for the long term, while others actively trade in the market to profit from price fluctuations. Understanding these strategies can help investors make informed decisions about managing their digital currency investments.

#### 5. Risks and Challenges of CryptocurrencyInvesting in cryptocurrency isn’t without its dangers. The market is known for its high volatility, with prices frequently experiencing large swings in a short period. Alongside this volatility are security risks, including hacks that have resulted in significant financial losses for investors.

Regulatory challenges are also a concern. Governments worldwide are still figuring out how to regulate cryptocurrencies, which can create uncertainty for investors. Understanding these risks is crucial to navigate the cryptocurrency landscape effectively.

#### 6. Future of CryptocurrencyLooking ahead, many experts predict that cryptocurrencies will continue to grow in popularity and acceptance, with institutional investors increasingly entering the space. The integration of digital currencies into everyday transactions, such as retail purchases and remittances, could signal a transformative shift in the global financial system.

Moreover, ongoing advancements in technology, regulatory clarity, and infrastructure development will likely provide a more stable environment for cryptocurrency to thrive. An examination of these future trends can aid investors in planning their strategies effectively.

### 相关问题 #### 1. What are the main benefits of using cryptocurrency? #### 2. How does one safely store cryptocurrency? #### 3. What should I know before investing in cryptocurrency? #### 4. How do taxes work with cryptocurrency trades? #### 5. What are the environmental impacts of cryptocurrency mining? #### 6. How do I choose the right cryptocurrency to invest in? 以上结构为您的加密货币英语解说稿提供了一个全面的框架和主题。每个部分都可以扩展为800个字的内容,以达到总体字数要求。